Executive summary

Feb 27, 2020

3 min to read

Are you a foreign investor into Canada? Are you considering investing into Canada?

There are several international treaties to which Canada is a party that favour international trade and investment that you need to consider when preparing your investment plan into Canada.

Is your country of origin a signatory to one of these Free Trade Agreements? If so, your business could benefit from a series of trade advantages afforded under these agreements. Most notable is the tariff free access of your businesses goods into Canada, but many other measures are included in the agreements to enhance and facilitate trade, all of which should be reviewed as you prepare your investment plan into the Canadian market.

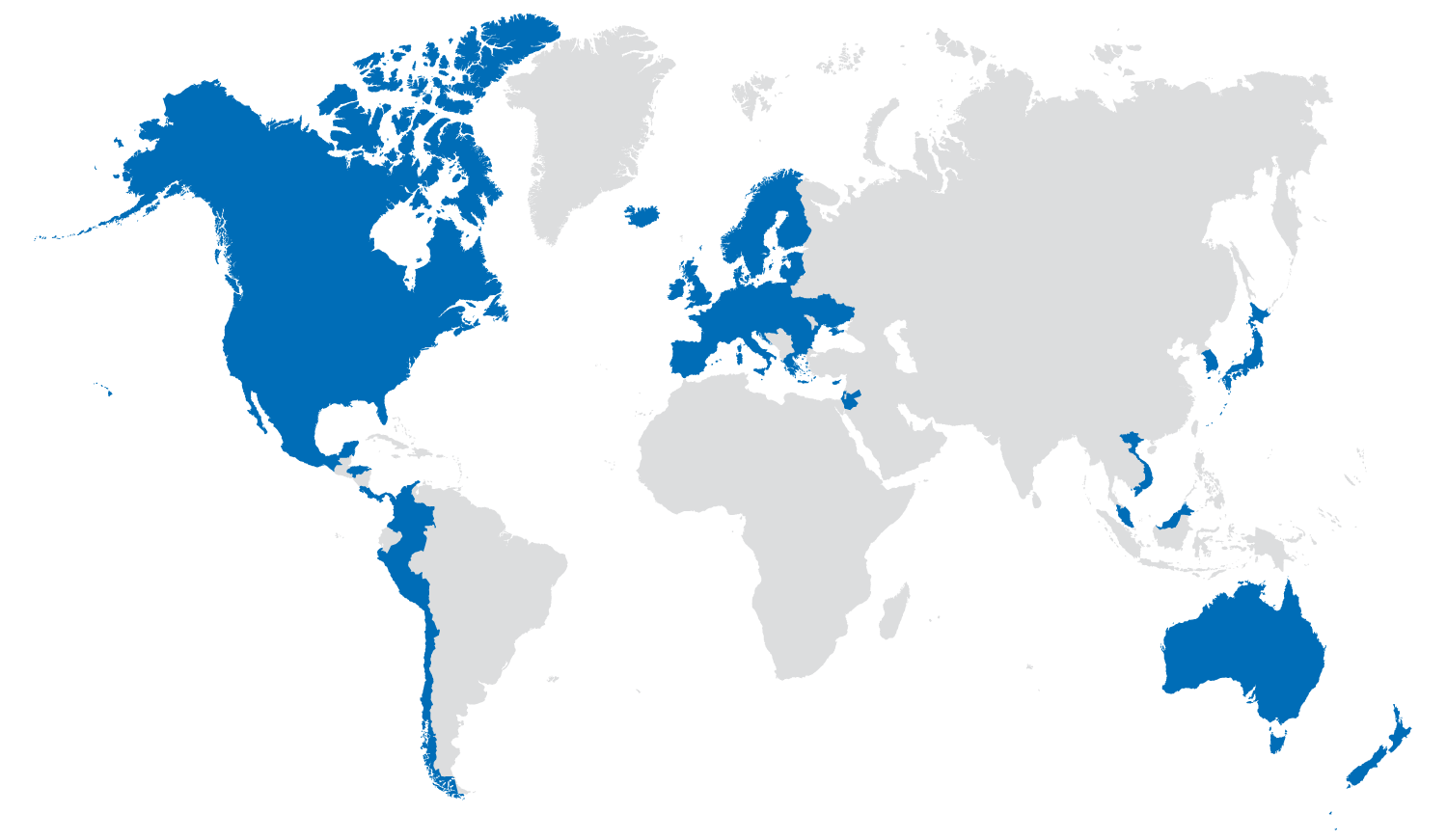

States with which Canada has concluded a trade agreement:

Your business is not based in one of the 53 countries with whom Canada has concluded a free trade agreement? Know that Canada has concluded 38 foreign investment promotion and investment agreements and perhaps your business’s country of origin has advantages under such an agreement. While not as wide reaching as an FTA, FIPAs provide protections and rights that enhance trade and should be part of your risk assessment when trading with Canada.

Canada has concluded tax treaties with 93 countries. While complex in their scope and implementation, notable provisions in a tax treaty will include issues such a tax residency, double taxation, business profit taxation, royalties, dividends and capital gains. Always bearing in mind that a foreign investor will want to send some of the money made in Canada back to their country of origin, a proper tax strategy needs to be considered early in the investment process to avoid future tax surprises and transaction optimization opportunity cost..

Since 1986 the Convention on the Recognition and Enforcement of Foreign Arbitral Awards (1958) (New York Convention) rendering arbitration rulings enforceable internationally in countries party to the convention, applies in Canada making the arbitration of disputes an option to be actively considered by any foreign investor fearing the submission of a dispute to local courts. As such, a foreign investor can choose to litigate their dispute by way of arbitration anywhere in the world where the convention applies and have an arbitration decision enforceable in Canada.

All terms and conditions of the sales of goods by any foreign person selling goods to a person in Canada will automatically be subject to the Vienna Convention of 1980 provided that the seller’s country is also a signatory to the convention. Amongst the provisions that automatically apply to the sale of goods are those related to implicit guaranties regarding the goods sold, including fitness for purpose, which may be more stringent than those provided in the seller’s domestic legal regime. A foreign seller should know that they can contract out of the Vienna Convention of 1980.