Executive summary

Mar 2, 2020

0 min to read

Between 65% and 70% of new issuers listed on the above-mentioned stock exchanges, including the CSE, have actually done so through an RTO [1]. This is notably the case for many companies, both Canadian and American, operating in the cannabis industry since its legalisation in autumn 2018, and notably on the CSE, a stock exchange that was originally more lenient in its listing of companies operating in this particular field [2].

For example, between 2016 and August 2019, 85 new listings on the CSE were made through IPOs, compared to 163 through RTOs or non-offering prospectus listings [3], which will be reviewed in a future publication.

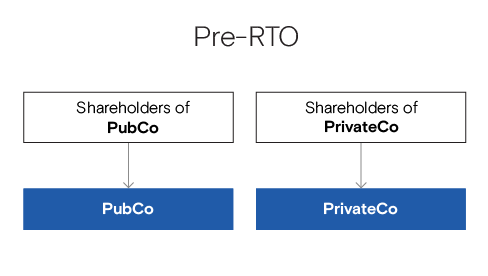

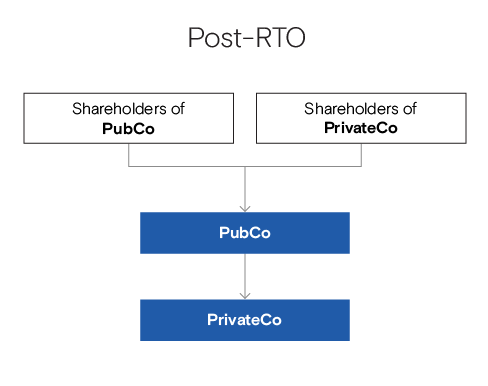

An RTO is a transaction pursuant to which a company listed on a stock exchange ("PubCo") with few or no assets, acquires all the shares of a private company with assets or substantial operations ("PrivateCo"). This acquisition will be made by issuing shares from the capital of PubCo to the shareholders of PrivateCo in exchange for the share capital they hold in PrivateCo, taking into account an exchange ratio based on the value of PrivateCo's assets or operations. Such a transaction will most often take place by way of share exchange, merger or arrangement, depending on the most appropriate tax structure for the proposed transaction.

Therefore, the result of such transaction is for PrivateCo to indirectly go public. PubCo, while remaining listed on the relevant stock exchange, now holds the assets or operations of PrivateCo, but has undergone a change of control, as the shareholders of PrivateCo will generally hold a majority interest (a controlling stake of at least 20%) in PubCo following the closing of the RTO; changes to its composition of the Board of Directors will likely occur to reflect this change of control.

Despite these drawbacks, the RTO procedure is a relatively quick and efficient method of accessing capital markets.

While it is theoretically possible to complete an RTO in three to four months under ideal conditions, a more realistic timeframe, which takes into account some minor delays, would be six months or more. Issues that may cause such delay and that should be taken into account here include: the time needed to find the appropriate public vehicle, the due diligence for each party, the time required to hold a potential shareholders' meeting for the public company or to obtain audited financial statements for the private company.

Our professionals are at your disposal to advise and assist you in this process, as it is essential for any company that is considering proceeding with an RTO to be adequately prepared in order to identify all the issues related to this type of operation, not only in the corporate and securities fields, but also with respect to tax-related matters.

[1] Source: GoPublicInCanada.com [2] 193 companies listed on the CSE are involved in the cannabis business, compared to 15 on the TSX and 33 on the TSXV (Source: cse.com - CSE Canna List/mjobserver.com) [3] Source: CSE Report August 2019

For more on which growth strategies to choose when dealing with foreign investors, register to our Strategic Forum on Foreign Investment.

Find out about this event