Executive summary

Oct 8, 2020

4 min to read

There is no getting around it: obtaining a patent is an expensive and long process. Why should a startup spend its limited resources on patents? Is there any point in acquiring a patent if said startup can’t afford litigation costs against larger companies that may infringe their patent? These are fair questions that most startups should ask themselves.

As with most things in law, it depends.

In some scenarios, the best course of action is to market innovative technologies as soon as possible. Being the first to market can potentially provide a competitive advantage. For example, consumers may not have another comparable option, thereby increasing the popularity of the startup. This phenomenon is sometimes referred to as “first-mover advantage”. In the absence of a patent, however, this can sometimes backfire, as competitors can quickly copy products.

In other situations, startups might publicly disclose their innovative technology. For a technology to be patentable, it must be novel and non-obvious; publicly disclosed technology can therefore render a competitor’s technology non-novel, and therefore non-patentable. This inexpensive strategy can open the market to more players.

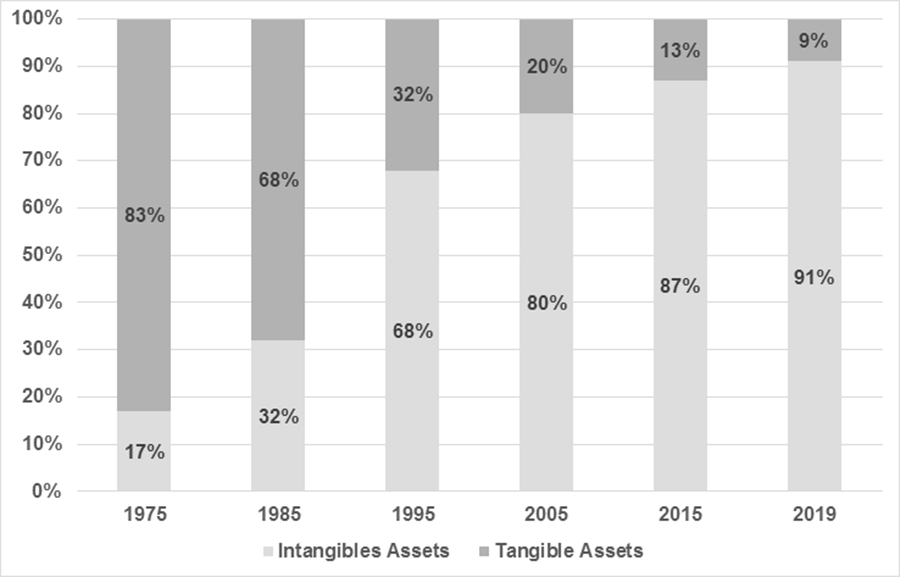

Patents are not just documents that are stored somewhere, and forgotten; they are investments. In fact, according to a study by Ocean Tomo, in 2019, as shown in Figure 1, 91% of the value of the Standard & Poors 500 Index (S&P500) was from intangible assets, which include patents, trademarks and branding. It is also worth noting that if a startup or a company falters, their patents do not become obsolete; they can be sold.

Figure 1: Shift from tangibles to intangibles. Components of S&P 500 Market Value

Patents attract investors. If a large company, such as Sony or Samsung, has reason to believe that the patented technology of a smaller company will be useful, they may invest in the smaller company. Mobeewave, a Montreal-based company that BCF accompanied with the development of its patent portfolio, initially garnered interest from Samsung, who invested in them. A few months ago, Mobeewave was reportedly purchased by Apple for 100 million dollars. In this case, Mobeewave’s patented technology paid off.

Patented technology can also lead to collaboration between companies. For instance, some companies may come to a cross-licensing agreement. Patent owners can monetize their patents by licensing them to one or more companies, generally in exchange for royalties. The license grants the right to manufacture and sell the patented technology. In a cross-licensing agreement, rather than paying royalties in exchange for licenses, the parties involved in the agreement exchange licenses for patents they respectively own. In other cases, companies might decide to work together to jointly develop new technology.

Sometimes, competitors will enter the market with the intention of copying a company’s technology. In cases where this technology is not patented, the competitors are free to copy it without any consequences. In cases where the technology is patented, competitors may copy it with some modifications to avoid infringement lawsuits. Making such modifications can cost significant amounts of money, and the result will likely not be as effective as the patented technology. This discrepancy could incite consumers to opt with the patented technology. As such, the patentee — the owner of the patent — has a competitive advantage. In other cases, patented technology could dissuade a competitor from even entering the same market.

A frequent misconception about patents lies in the fact that even though you obtain patent protection for your technology, your technology may nonetheless infringe patents of others. In other words, obtaining patents for your technology does not remove the risk of infringing someone else's patents but having a patent portfolio may deter a competitor from taking action and suing, for fear of a counter-lawsuit. This logic can be simplified to: “If you sue me, I sue you”. Rather than spending a lot of money in courts, parties involved in legal battles could come to a settlement, such as a cross-licensing agreement. Taking into consideration the high cost of patent litigation (which may potentially reach millions of dollars), avoiding it is an important incentive for startups to build a patent portfolio.

To summarize, although often wrongfully dismissed, patents play a key role in the growth of companies, from grassroots organizations to market leading companies.

BCF’s Patents team can help optimise the value of your innovations. Should you have any questions regarding this article or patents in general, please do not hesitate to contact our team.